Is Commercial Real Estate on the Decline?

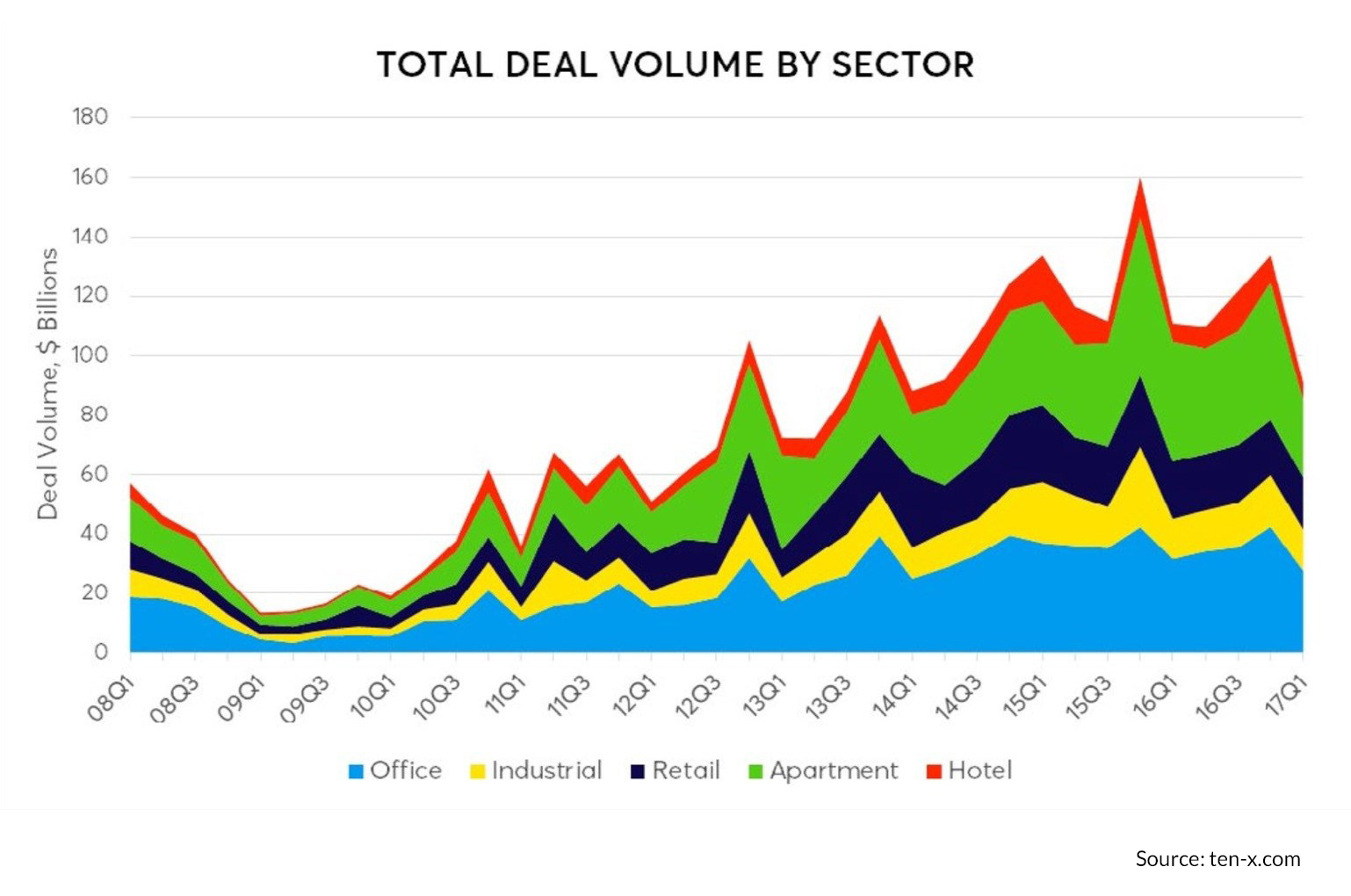

After enjoying two consecutive quarters of growth, the United States commercial real estate (CRE) market declined sharply in the first quarter of 2017. This decline was significant, dragging CRE investments below $100 billion for the first time since the beginning of 2014. Total CRE market investments remained strong at $90.9 billion for the quarter, but this number represents a 32% decrease from the final quarter of 2016. First quarter 2017 numbers were 18% below the first quarter of 2016 and 43% below the market’s peak in 2015.

(PRNewsfoto/Ten-X)

Naturally, the need for CRE continues to shift as more businesses attempt to shift their business activities to the virtual world. Political factors, however, are having a profound effect on the current CRE market.

In an industry where uncertainty plays such a large role, the reasons for this decline seem clear. Peter Muoio, chief economist at the Ten-X real estate marketplace, blames several contributing factors for the decline. One is the lack of clarity from the current administration on several issues that will affect the commercial real estate market. Worldwide political upheaval may also be to blame. Another significant political factor affecting CRE is the new accounting standards being applied to real estate investment trusts. These new rules greatly increase the administrative costs of certain real estate investments.

Ironically, another reason for the CRE investment decline may be the current strength of the stock market. As investors are well aware, bull markets don’t last forever. At eight years old, the current bull market is one of the longest in history. Savvy investors know, however, that all good things must end, and many feel that a bear is surely looming.

The news isn’t all bad, however. In spite of the CRE market decline, the prices of commercial properties are increasing by approximately 10% per year. The value of office space increased by 22.3% from 2016 to 2017 while apartment values have gone up 15.2% during the same time. While price corrections could be coming, investors still have reason to expect positive outcomes in spite of the market’s recent decline.