CRE to the rescue!

Yes there is so much uncertainty with almost everything. Global economies, political strife, global environmental practices now affect our domestic investment decisions. Many of these and other factors seem to be beyond our control. Slowly commercial real estate has been building a solid story of predictability. But consider the following concurrent issues creating uncertainty:

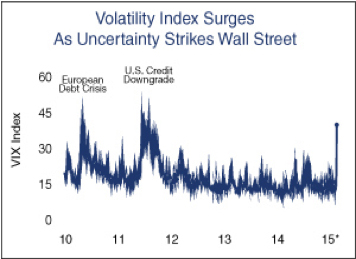

- The stock market volatility index (VIX) continues to forecast investor’s lack of confidence even after the market (DJI) lost 1300 points in two weeks.

- China’s growth has slowed; their currency devalued causing disruption in commercial trade.

- Oil and commodity prices are down lead by $45 / barrel oil.

- The Federal Reserve is hesitant to increase short term rates as promised.

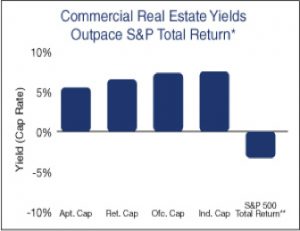

- CRE has outpaced S&P returns to date with lending, investing and selling real estate increasing year over year.

As we begin September 2015 institutional-quality real estate pricing continues to rise with cap rates remaining historically low. Recently however lower quality smaller properties have been selling in increased numbers and averaging 14% annual increased price appreciation according to CoStar Commercial Repeat Sales Indices. In fact net absorption across all asset classes totaled 575.5 million square feet over the past 12 months and was the highest on record since 2008.

This good news for investors hasn’t been unnoticed. Watching for another real estate “bubble” the Federal Reserve Bank’s Semiannual Monetary Report to Congress reported concern for commercial property’s rapidly increasing prices and the deterioration of CMBS activity reported by Moody’s investment services. Mitigating concern by the regulatory agencies is the increased capital required by banks for construction and development loans. Current bank construction loans outstanding are down from 2008 levels of $630 billion to $236 billion and growing slowly. Private lenders some referred to as “Shadow Banks” firms act like lenders ( but don’t have depositors, federal regulators or access to the Federal Reserve bank discount window) have expanded their market share and now account for $150 billion of $500 billion of total 2014 commercial mortgage activity with considerable growth in construction activity. The Fed seems pleased risk has been reduced in the banking system but they have been seeking greater regulatory oversight of this activity by the SEC. The Federal Reserve expects to dampen this increased real estate activity by increasing short term rates at future Fed meetings.

Mortgage Bankers Association has reported commercial mortgage activity increased 29% year over year for the first 6 months of this year. Borrowing increases were broad based across most types of CRE except health care. (-50%) (Multifamily (+58%), industrial property (+32%), office (+22%), retail (+17%) and hotel (+16%)

All commercial mortgage originators increased activity year over year. Leading all originators were agencies Fannie Mae and Freddie Mac with 113% increased originations. Banks increased volume by 64% taking greater interest rate risk and insurance companies continued their growth trend now increasing volume by 14%. Banks had the highest quarterly volume in the last 5 years while they try to offset margin decline with volume. 2015 CMBS activity totaled more than $49.6 billion in six months which supports the $100 billion forecasted this year but swap spreads continue to widen and liquidity moderated in August with economic uncertainty. Individually institution volume was led by Deutsch Bank and Wells Fargo but collectively 56% of CMBS volume was originated by conduits. The lodging sector has seen the largest increase of issuance ($13B) now exceeding any time in the last 3 years and loan to values are increasing to now 70.19% depending on property type.

Commercial mortgage real estate investment trusts (mREITs ) are playing an increasing role in the commercial real estate lending market. mREITs predominately originate commercial mortgages to hold on their balance sheet but they also originate conduit loans securitizing for sale and they invest in commercial mortgage-backed securities. Collectively 13 Mortgage REITS hold $32.2 billion in assets and are up 52% since 2010. Since mREITs are less regulated than banks they have become a significant competitor for banks and are expected to take an increasing share of the $350 billion maturing CMBS loans maturing in the next 2 years.

In summary investors have found commercial real estate investment returns to be rewarding and perhaps a more certain return than other asset alternatives. Most assuredly if absorption is finally dramatically increasing you can be sure rental rates and increased construction will follow. Existing and new private lenders are aggressively providing low cost financing and if rental rates increase with absorption even increased rates won’t necessarily slow down the momentum. With current uncertainty in other investible assets CRE is here offering what can’t be found elsewhere.