We find 2016 is upon us beginning with a historic decline in the stock market, crude oil at record lows, the dollar strengthening with domestic employment growing in an election year certain to change US leadership. Globally most industrialized countries’ growth has slowed most notably China and currency valuations have been used to improve export growth to the US. Concurrently we have had multiple year growth in CRE market with most segments growing and exceeding 2007 activity levels with abundant debt and capital available. The wealth of this country has been confidently spending and investing during this recovery and the global wealth increasingly finds the US CRE market as a safe and an appreciating market. What could be of concern?

Demographics

Demographics – Aging “Boomers” have either accumulated wealth and security which they are investing or spending but more than anticipated where permanently negatively affected and will need social service support for the remainder of their life. The all be it smaller in number the “Xers” are busy attempting to save and provide for later retirement but have not had the previous generations wage growth and now realize as the first generation that will not do as well financially as their parents did. The newest Millennial generation is quickly growing into purchasers and now exceeds in number the “Boomers”. Every type of real estate product is now becoming influenced by them.

Interest Rates

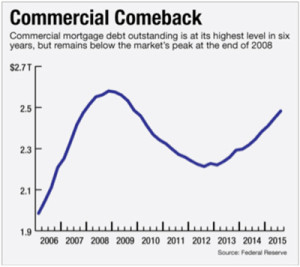

Interest Rates – The Federal Reserve has increased interest rates the 1st time since 2007. So far this has not affected CRE but flattened the cure leaving long term rates with little change but the fed and others forecast up to 3 more increases during the year. Will the interest rate continue to flatten? What effect will this have on cap rates, values and available financing?

Regulation

Regulation – Federal Bank and SEC Regulators with examination, new regulation, and enforcement are implementing constraints to CRE growth affecting the two largest providers of CRE debt, Banks and CMBS. Without going into detail all the following are announced and in some form of implementation:

- BASAL III (Banks and CMBS)

- Fed CRE Concentration guidance (Banks)

- SEC Regulation AB (CMBS)

- FASB / CECL (Banks)

- FASB / Investments 825-10 (Banks)

- FASB Multi-year lease treatment ( All companies)

- Money Market Rules (Banks)

In spite of the concerns above the underlying demand drivers of job growth, consistent retail sales growth and strong demographic trends are encouraging commercial real estate investments. Vacancies have tightened for all property types and in most markets demand has outstripped new supply. Resulting increasing rent growth will remain a positive driver as investors consider future yields. This will result in increasing transaction activity supported by increasing debt throughout 2016.

In spite of the concerns above the underlying demand drivers of job growth, consistent retail sales growth and strong demographic trends are encouraging commercial real estate investments. Vacancies have tightened for all property types and in most markets demand has outstripped new supply. Resulting increasing rent growth will remain a positive driver as investors consider future yields. This will result in increasing transaction activity supported by increasing debt throughout 2016.